As a new homeowner,

your home is one of your most valued investments. It is important that you receive an annual updated assessment of your property’s value. That’s what BC Assessment provides you along with a variety of helpful online property information and resources to assist with understanding your assessment.

Accessing your annual property assessment

BC Assessment is responsible for providing you with the assessed value of your property on an annual basis.

BC Assessment is responsible for providing you with the assessed value of your property on an annual basis.

Each January, we deliver an

Assessment Notice to you that informs you of the updated value of your property. View this short

video to learn more about

how BC Assessment determines your property's assessment.

You can access your property's assessed value, and other property information, anytime by simply entering your address on our online 'Find your property assessment' service.

Register with BC Assessment

Sign up for a free, customized

account to access advanced property search functions for your property on our online 'Find your property assessment' service.

With an online account, you will be able to:

- Access your property's annual assessed value, 10-year historical values and sales history

- Check recent sales of the homes in your neighbourhood to get an ongoing sense of your home's changing value (sales are updated monthly)

- Use the interactive map features for searching and browsing properties

- Create and save property comparisons/favourite properties to compare those properties with your own

- Search, view, save and compare details for any property in British Columbia

Already have an account?

Log in

What you need to know about your assessment

Almost all homes in BC are classified as "Class 1 – Residential". Taxing authorities use

property classifications to help distribute property taxes.

July 1 valuation date

-

Property assessments are updated annually

Property assessments are updated annually - Assessments represent the property's market value as of

July 1 each year. This is the same date used to value all properties in B.C.

- When you receive your annual Assessment Notice in January, it will be based on what your property could have sold for in the local real estate market on July 1 of the previous year.

- To determine your home's current market value at any particular time, it is best to consult a realtor or private appraiser for the actual value in the most current real estate market for your neighbourhood.

October 31 physical condition & permitted use

-

Any changes to your property, such as home renovations, will be considered in your upcoming assessment based on the physical condition of the property as of October 31.

Any changes to your property, such as home renovations, will be considered in your upcoming assessment based on the physical condition of the property as of October 31. - If your property is rezoned as of October 31, this may also impact your upcoming assessment.

- If you change the use of your home as of October 31 to include a business or other non-residential use, then this may impact your upcoming assessment and your property's classification.

Learn more about Valuation Date versus Physical Condition Date.

Your property assessment & property taxes

Our property assessments are used by local governments to calculate the distribution of property taxes used to finance important community services.

Our property assessments are used by local governments to calculate the distribution of property taxes used to finance important community services.

BC Assessment's role:

- Deals solely with the assessment and classification of properties and has no authority or control over taxes or property tax rates.

- Provides you with your individual assessment, your annual assessment change in value as well as the average change for your property classification for the entire local jurisdiction (e.g. municipality).

- Provides all the property assessments within your local jurisdiction to your local municipality or taxing authority.

Your local taxing jurisdiction's role (e.g. municipality)

- Each year, your local jurisdiction approves a budget to finance the expenditures related to the local operations and services of your community.

- The necessary tax rates and tax distribution are calculated to ensure adequate revenue for your local community.

- Tax notices are prepared and mailed to all property owners in the spring of each year.

- Your taxes are collected and your community is funded for the year.

*

Unless your taxing authority has enacted an alternative municipal tax collection structure under Section 235 of the Community Charter.

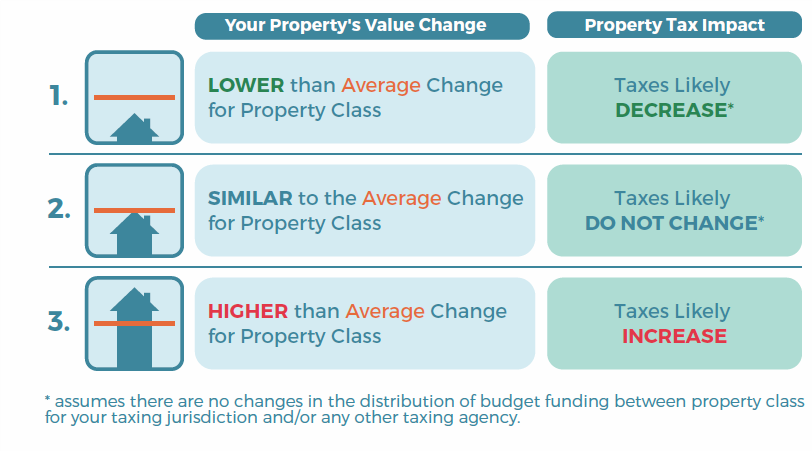

How assessments impact taxes?

An increase or decrease in your property assessment does not necessarily result in a corresponding increase or decrease in your property taxes.

The most important factor is not how much your assessed value has changed, but how your assessed value has changed relative to the average change for your property class in your municipality or taxing jurisdiction.

You can find your municipality or taxing jurisdiction's average change listed on your annual assessment notice or via BC Assessment's online

interactive map.

Learn more about

Property Assessments and Property Taxes: a not-so complicated relationship.

Addressing concerns about your assessment

As a homeowner, you are an important customer of BC Assessment.

Provide us with

corrections/updates to update your property information.

Upon receiving your annual Assessment Notice and if you disagree with the assessed value of your property, here is what you should do:

- visit

bcassessment.ca and search your property

- confirm your property information

- compare your assessment to sales of similar properties in your neighbourhood.

If you still have questions,

contact us before the deadline to file a complaint (appeal), which is typically January 31.

Appealing your property assessment

If you are still not satisfied after discussing your concerns with us, then an independent complaint process is available to review your assessment through the Property Assessment Review Panel (PARP).

Your complaint must be submitted no later than January 31. As a homeowner, it is important to understand that you cannot appeal your taxes. Neither the Assessor nor the PARP can consider taxes when establishing the assessment value of your home.

Learn

more about the

assessment appeal process.

___________________________________________________________

Read our new home buyer

brochure for more information about BC Assessment.