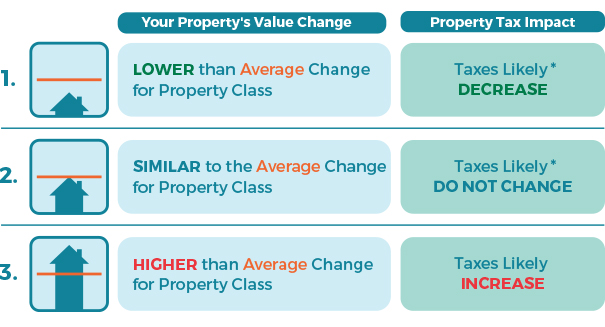

A common misconception is that a significant change in your assessed value will result in a proportionately significant change in your property taxes.

The most important factor is not how much your assessed value has changed, but how your assessed value has changed relative to the average change for your property class in your municipality or taxing jurisdiction. You can find your

property class on your assessment notice next to your assessed value.

Click here to find the average change for your property class in your jurisdiction.

*The diagram above and the scenarios below assume stable tax rates and no changes in the distribution of budget funding between property classes for your taxing jurisdiction and/or any other taxing agency.

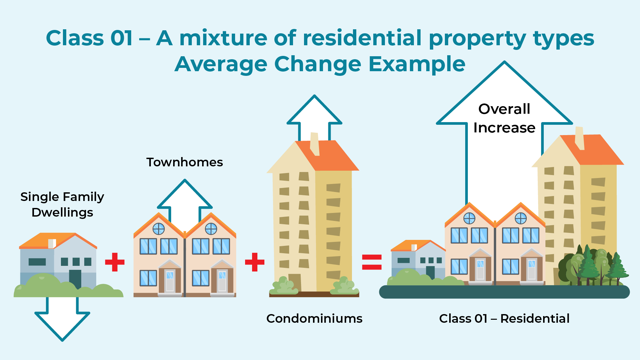

Understanding average change across different property types

It is also important to remember that average change is calculated at the property class level, which encompasses a mixture of different property types, all of which can increase or decrease at varying levels. For example, the Residential property class includes properties like single-family dwellings, townhomes, and condominiums. The average change will be impacted by the magnitude of change for each property type, and how many of each property type there are in your municipality or taxing jurisdiction. As illustrated below, even though single-family dwellings decreased in this jurisdiction, townhomes and condominiums increased, resulting in an overall average increase for the property class.

Here are some examples of the potential impact to your property taxes with value changes more than the average change, and less than the average change.

Example A: Your property is currently assessed at $540,000, based upon a valuation date of July 1 last year. Your previous assessed value was $450,000. Your property increased 20% in value, while the average increase for your property class was 30%.

Since your property increased

LESS THAN the average for your property class, you will likely see a decrease in your property taxes.

Example B: Conversely, your property is currently assessed at $630,000, based on a valuation date of July 1 last year. Your previous assessed value was $450,000. Your property increased 40% in value, while the average increase for your property class is 30%.

Since your property increased

MORE THAN the average, you will likely see an increase in your property taxes.

Click here to download pdf of the infographic explanation.

The information on this page is for information purposes only. If your residential property is valued at $3 million or more, the property tax implications may be different than stated above. For more information, visit the

BC Government's school tax website. For specific questions about property taxes, please consult your municipality or taxing authority.

Understanding the property tax process

An increase in your assessment does not necessarily mean an increase in your property taxes. Property tax changes are generally impacted by your assessment's change relative to your community's average assessment change.

How property assessments impact property taxes

Detailed Explanation of Property Assessments & Property Taxes