Assessment search is a publicly available online service for private, personal, non-commercial use. It provides easy access to property information about most taxable properties across British Columbia with the exception of some Indigenous properties, and properties with certain use codes; including recreational properties, such as parks and playing fields, and major industrial properties, such as pulp mills, and utilities.

All of the required search information is found on the assessment notice. (i.e. address, roll number, PID or plan). If you do not have your assessment notice,

please contact the Regional Office in your local area to request a copy.

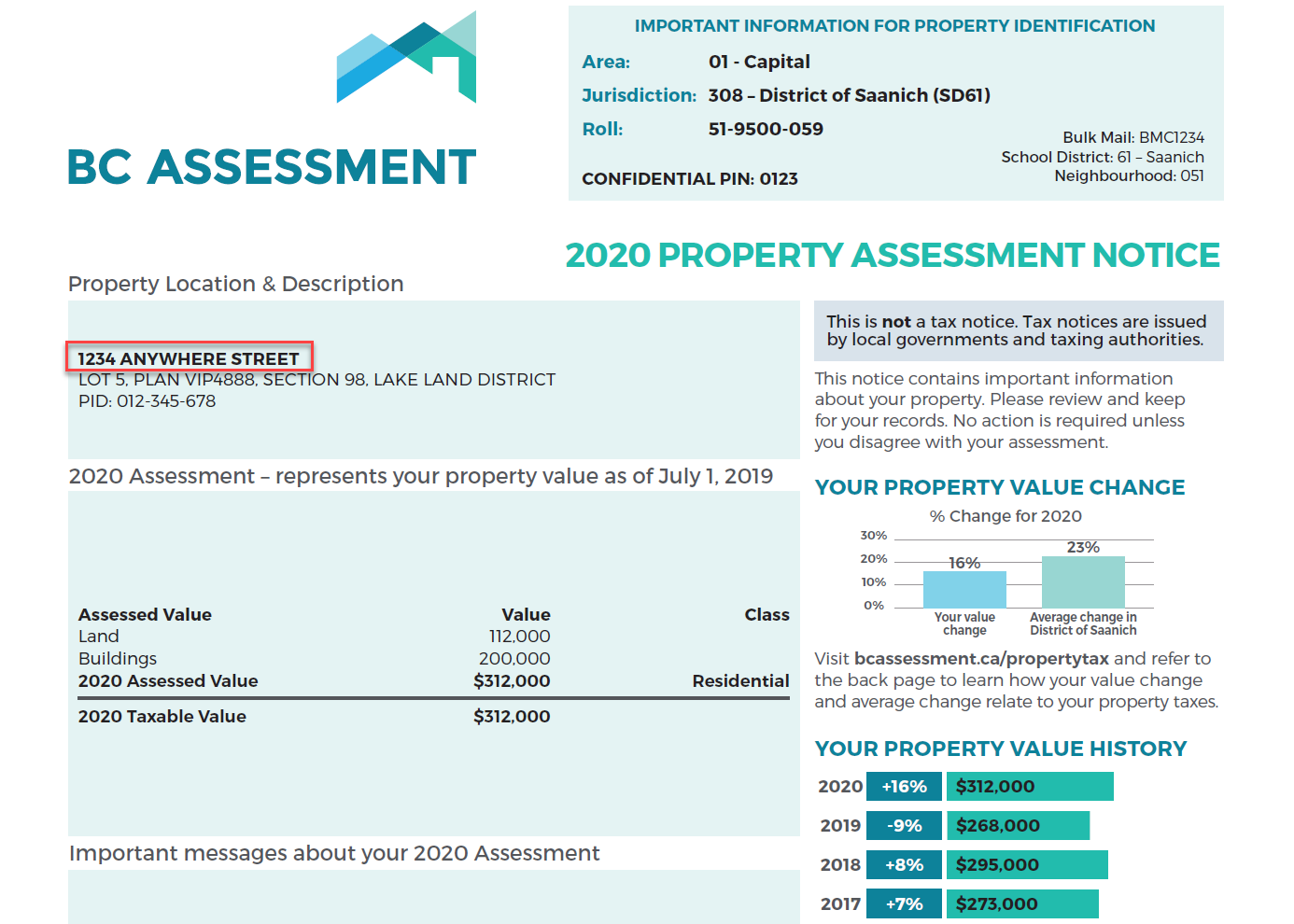

For address: Follow the suggested format provided in the search bar for optimal results. Type in the address given at the bottom of the assessment notice. Make sure to include special characters (i.e. “-“) and spaces. If the address has a unit # but there is no “-“between it and the street number, type it in the search bar without a “-“. In the example below you would type: 1234 Anywhere Street.

For roll number: The roll number is usually unique for each property, but there are some instances where this is not true. To ensure that you get the correct property for the roll number you have, enter the jurisdiction number located above the roll number at the top right of the assessment notice first, and then the roll number. Do not include the “- City/Town name” shown on the notice.

The jurisdiction number and roll number should be typed in the search bar in the following format. In the example below you would type: 308 as jurisdiction number and 519500059 as roll number.

For plan: The plan number is not a unique identifier for a property. As a result you must type in a few other property identifiers that in combination will retrieve the property you are looking for. The full set of property identifiers are the plan number, lot number, jurisdiction number (without the city or town part), and the roll number. These identifiers can be found on the property assessment notice in two places: the box at the top right (jurisdiction and roll) and the box near the top left on the notice (lot number, plan number). Please review the picture below. The numbers must be typed in the search bar in the following format, including special characters and spaces. The auto-complete will make suggestions below the search bar and you can select the correct one as soon as it is displayed in the list.

In the example below you would type: VIP4888 as Plan and 5 as lot.

For PID: A parcel Identifier, or PID, is located on the property assessment notice in the Property Location & Description box. See the image below for the location of your PID on your assessment notice. When searching by PID, dashes(-) are not required.

In the example below you would type: 012345678.

If no auto-complete options are displaying below the search bar this indicates that:

● The information being keyed-in for which Assessment search has no records;

● A cut-and-paste method has been used to enter information, or

● The information is not recognized as an address by the search routine (use the watermark in the search bar as a guide to how to format the address). You may have to refresh the browser to see the watermark.

Search for a condo/strata building the same as you search any address. When the address search determines that a strata building is being searched on, it displays a subset of the units and indicates on the first line or two, the option to list all of the strata units. If the unit you are looking for is not on the initial list, simply click on the line with the wording “select to see all units…" and this will take you to a new page with the full list of strata units within the building. From this list, select on the individual unit of interest.

The Assessment Act permits BC Assessment to provide a street front image for each property.

Property owners do not have the authority to request that their BC Assessment street front property image be removed from the assessment search service. There are two kinds of property images displayed in Assessment search: BC Assessment street front images and Google StreetView images.

Nearly 80% of properties include images. BC Assessment images obtained through the street front program will remain on the service as per our policy, unless a specific problem with the image is identified (for example a licence plate is readable). Each image obtained through the street front program has been confirmed to comply with the province of BC’s privacy legislation. To report a problem with a property image in assessment search, please click “Report a Problem” at the bottom of the property image or

click here.

The Assessment Act permits BC Assessment to provide a street front image for each property.

Google provides a process that enables property owners to request that parts of or all of the Google StreetView image of their property (identified by the Google watermark on the image) will be blurred. The Google process can be accessed

here.

Updating property images is a significant undertaking for such a geographically large province as British Columbia. While we strive to have property photos as current as possible, not every property can be updated frequently due to geographical and accessibility constraints.

In some cases, there is no image because neither Google nor BC Assessment has taken a street front image of the property or the image may not be available.

Assessments are updated annually and represent the property value as of July 1st of the prior assessment year. For example, if you are using the assessment search service in the year 2018, the assessment information is current as of July 1, 2017. A second, smaller update occurs in April of each year to reflect the decisions of the Property Assessment Review Panels (PARP).

The following list represents all property information displayed (when available and applicable) on assessment search in the property detail page:

Property information

● Civic address (apt/house #, street name, city, postal code)

● Area, jurisdiction, roll#

● Street front or Google image

● Legal description

● Parcel ID (PID)

Assessment information

● Total assessed value

● Property assessment date

● Land value

● Building(s) value

● Previous total value

● Previous land value

● Previous building(s) value

Building information

● Year built

● Description

● Number of bedrooms

● Number of bathrooms

● Carports

● Garages

● Land size

● First floor area

● Second floor area

● Basement finish area

Additional information if applicable

● Strata area

● Building storeys

● Gross leasable area

● Net leasable area

● Number of apartment units

● Manufactured home width, length and total area

● Sales history within the last 3 full calendar years

● Comments on the property i.e. Property has more than one structure

The description field in assessment search describes the primary structure on the property. The description defines the type of building (i.e. strata apartment, retail store, house, etc.) and often provides additional descriptive information.

In the case of houses, it includes the number of storeys and a quality rating to assist you in finding appropriate comparable properties. These are quite generic descriptions that reflect construction quality and design. The particular characteristics used to categorize a dwelling as, “basic, standard, semi custom and custom” will depend on the era when it was built. Generally though, they are rated in the following order from lowest to highest quality:

Basic: Modest, economical housing of its era, built with minimal design features and few, if any, decorative features.

Standard: Very typical for its era, having met basic building code requirements of the time, and was built with average quality building materials.

Semi custom: Compared with standard housing, a semi-custom house incorporates some more complex design features, as well as some better-than-average materials and amenities.

Custom: Built with considerable attention to architectural design and decorative features, using good-quality building materials.

The number of storeys is the number of distinct levels of living space above the basement, crawl space or slab foundation. Some homes with above-ground basements appear very similar to 2-storey homes; typically the level containing the living room and kitchen is counted as the first storey. A half storey level has exterior walls that are less than full height.

Municipalities will typically inform BC Assessment when issuing a building permit. BC Assessment will review this information and determine if an assessment requires updating. In some cases during this determination process, BC Assessment may visit the property site.

Contact BC Assessment at 1-866-valueBC (1-866-825-8322) to request a new copy. This service is delivered via email or post, at no cost. Proof of ownership is required.

Properties under construction (not renovations) will not show updated information until construction has been completed.

As a property owner in British Columbia, real estate is most likely your biggest asset. Knowing that your property’s assessed value is an accurate reflection of actual value is key in making fully informed property related decisions. The value of your property may have changed if you have:

● Renovated recently, such as updating your kitchen

● Added any new buildings to your property, such as a garage or carport

● Completed any additions to your home, such as a new bedroom

● Finished the basement, perhaps adding a secondary suite

If so, we encourage you to review your property details using our

assessment search online service. Learn more about updating your information.

In an effort to ensure the information BC Assessment uses to set assessed values is as accurate as possible, a request to update property details is often included with property assessment notices. By following the steps outlined on that request, you are helping to ensure your assessment is accurate.

In addition to those provided by the property owner, BC Assessment collects property details through home inspections, municipal permit information, building plans, satellite and street front imagery, orthographic imagery and a variety of other methods.

Yes - Sections 15 and 16 of the

Assessment Act permit BC Assessment to ask property owners for information to ensure fair and equitable assessments.

The personal information on these forms is collected for the purpose of administering the

Assessment Act, under the authority of both the Assessment Act and the

Freedom of Information and Protection of Privacy Act. An appraiser may need to contact you to clarify the information you have provided in order to ensure that your assessed value and property classification are correct.

Submitting a correction to your property details is not the same as appealing your assessed value. If you believe that an error in your property details has resulted in an incorrect assessed value, please consider the steps for

appealing your assessment. Appeals can only be filed between January 1st and January 31st.

The property details displayed on

assessment search are updated on January 1st, before property assessment notices are sent out, and again in early April. Any updates submitted between April and November will be reflected in

assessment search in the January update. It is important to note that all submissions will be reviewed by BC Assessment. If the submission indicates substantial differences, a BC Assessment employee will contact you to discuss the details of your submission.

In some cases, property details may not be available.