What is pre-roll consultation?

Pre-roll consultation is an opportunity for property owners or their agents to exchange information and dialogue with BC Assessment prior to the release of the Assessment Roll in January. Pre-roll consultation can lead to more certainty for next year's property assessment and help owner's budget for the upcoming tax year.

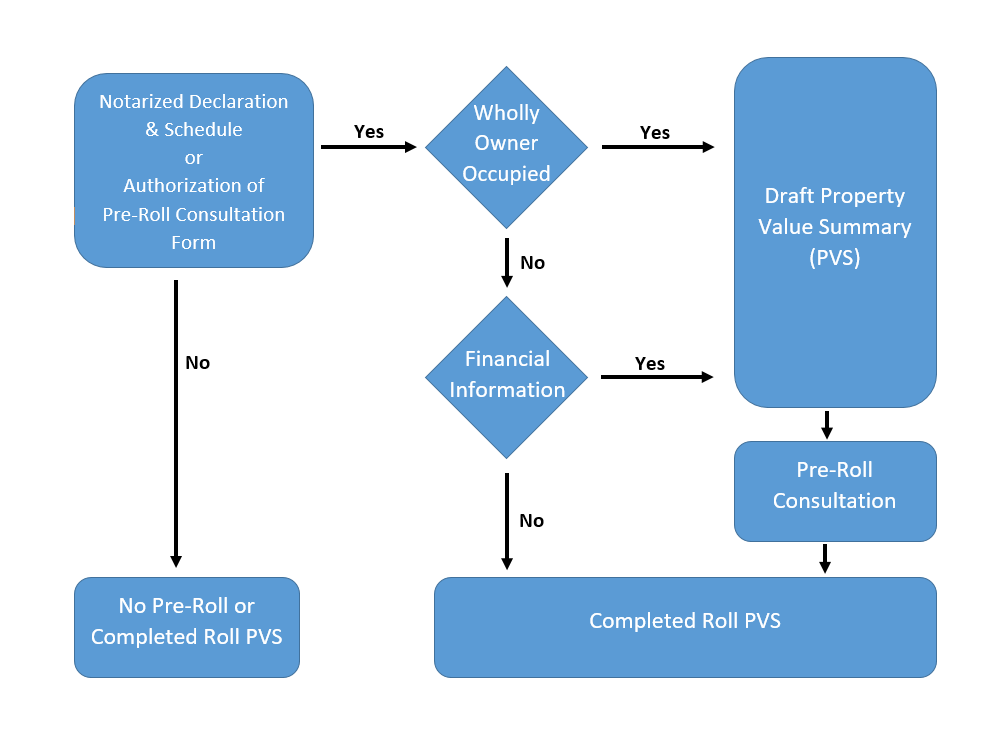

The pre-roll consultation process is relatively simple:

- In mid-August, the owner or agent will submit information and documentation pertinent to determining the assessed value of the property.

- For

IC&I properties, information, such as, but not limited to: the last three years of income and expense statements relative to the property, the rent roll as of July 1st 2025, appraisals, opinions of values with sales information by August 15, 2025.

- For

Strata Residential and Strata Mixed Use projects under construction, information, such as, but not limited to: a complete list of pre-sales by August 15, 2025. Detailed construction costs to October 31, 2025 must also be submitted during the pre-roll consultation period.

- If the appropriate documents have been submitted, BC Assessment will provide a draft property value summary (PVS) in October.

- With information exchanged, dialogue and in-person meetings can be arranged during the pre-roll consultation period.

To simplify the process of managing financial documents, please use the following file naming convention - [Area]-[Jurisdiction]-[Roll #]-[Financial Document Type]. E.g., 10-305-10000000-Rent Roll, 10-305-10000000-Income & Expense Statement (2025) etc.

If a financial document applies to multiple folios, please copy and submit a separate file for each folio (the number of copies should equal however many folios the financial document applies to), and use the same naming convention above, e.g., 08-221-10000001-Rent Roll, 08-221-10000002-Rent Roll, etc.

Owners & agents

Property owners may directly request a pre-roll consultation with BC Assessment. To participate, please submit your request and the required information (see #1 above) by August 15, 2025 to

preroll@bcassessment.ca.

Owners and agents may request a manual PVS for Strata Residential and Strata Mixed Use projects under construction by submitting a list (in Microsoft Excel format) with

Area, Jurisdiction, Roll Number to

preroll@bcassessment.ca by October 24, 2025.

Tenants

Pre-Roll consultation is not available to tenants, or their agents. Agents will still be able to receive completed roll PVS reports after paying the applicable fees (see Fee Schedule) for properties where they represent the tenant.

Agent representation

Property Owners may retain agents to represent them for the pre-roll consultation process. This declaration must be submitted to BC Assessment in one of the following formats:

These forms will be audited and authenticated by BC Assessment, and must be submitted by August 15, 2025. A letter may be sent to the property owner informing them that someone has requested information about their property on their behalf.

When complete, please return this form and any other appropriate documents to:

Pre-roll consultation calendar

WHO

| WHAT

| WHEN

|

Owners

| Submit information, and request a pre-roll consultation

| By August 15, 2025

|

Agents

| Submit information and appropriate agency declaration

| By

August 15, 2025

|

BC Assessment

| Deliver draft PVS reports for Major Retail, Hotels, Offices, and Major Development Land

| October 3, 2025

|

BC Assessment

| Deliver draft PVS reports for remaining property types

| October 24, 2025

|

BC Assessment

| Deliver draft PVS reports for partially complete structures

| November 3, 2025

|

Owners, Agents, and BCA

| Pre-roll consultation period

| October 3 to December 4, 2025

|

Agents

| Final deadline to request a Completed Roll PVS report with appropriate agency declaration

| December 4, 2025

|

BC Assessment

| Deliver completed roll PVS reports

| December 31, 2025

|

This process allows the property owner or agent to have input and provide feedback in the upcoming assessed values. The intent of the pre-roll discussion is to lead to a higher acceptance and understanding of the upcoming assessed values.

Although the draft assessments that result from pre-roll discussions and the completed January property assessment can sometimes be different, the pre-roll consultation process can help to minimize variances and lead to increased property tax certainty.

Pre-roll consultation process

If you have any questions about the pre-roll consultation process, please consult our

FAQs, or email

preroll@bcassessment.ca.

Completed roll property value summary

BC Assessment will provide PVS reports for all requested properties on December 31, 2025 where authorization has been satisfied and applicable fees have been paid.