KELOWNA — In the next few days, owners of more than 286,000 properties throughout the Thompson Okanagan can expect to receive their 2022 assessment notices, which reflect market value as of July 1, 2021.

"The real estate market has been robust in the Okanagan and most property owners can expect higher assessment values for 2022 with many communities seeing increases over 30 per cent," says Okanagan area Deputy Assessor Tracy Wall. “Sadly, we recognize that some Okanagan homeowners have been impacted by wildfires and flooding and they are encouraged to contact BC Assessment to discuss the damage to their property."

“The Thompson area real estate market has remained very active and that means most property owners can expect a notable increase for 2022," adds Thompson area Deputy Assessor Tracy Shymko. “Unfortunately, parts of our region have also been severely impacted by fires, floods and landslides and we are here to help such property owners with possible amendments to their 2022 assessments and invite any impacted property owners to connect with us if they haven't already done so."

As B.C.'s trusted provider of property assessment information, BC Assessment collects, monitors and analyzes property data throughout the year.

Overall, the Thompson Okanagan's total assessments increased from $159.3 billion in 2021 to $204.2 billion this year. A total of about $3.3 billion of the region's updated assessments is from new construction, subdivisions and the rezoning of properties. BC Assessment's Thompson Okanagan region includes the urban centres of Kelowna and Kamloops as well as all surrounding Okanagan and Thompson communities as listed below.

The summaries below provides estimates of typical 2021 versus 2022 assessed values of properties throughout the region.

These examples demonstrate market trends for

single-family residential properties by geographic area:*

Single Family Home Changes by Community |

2021 Typical Assessed Value

as of July 1, 2020 |

2022 Typical Assessed Value

as of July 1, 2021 |

%

Change |

| City of Kelowna | $650,000

| $869,000

| +34%

|

West Kelowna

| $632,000 | $856,000 | +34%

|

Lake Country

| $672,000 | $886,000 | +32%

|

Penticton

| $479,000 | $637,000 | +33%

|

Summerland

| $517,000 | $695,000 | +34%

|

Keremeos

| $304,000 | $449,000 | +36%

|

Oliver

| $416,000 | $557,000 | +33%

|

Osoyoos

| $433,000 | $600,000 | +35%

|

Princeton

| $252,000 | $339,000 | +30%

|

Peachland

| $590,000

| $820,000 | +39%

|

Armstrong

| $425,000 | $578,000 | +34%

|

| Enderby | $339,000 | $468,000 | +34% |

| Vernon | $479,000

| $644,000 | +34% |

| Coldstream | $606,000 | $817,000 | +32% |

| Salmon Arm | $426,000 | $574,000 | +34%

|

| Spallumcheen | $367,000 | $521,000 | +42% |

| Sicamous | $318,000 | $450,000 | +38%

|

| Lumby | $384,000 | $503,000 | +29% |

| City of Kamloops | $488,000 | $619,000 | +27%

|

| Barriere | $269,000 | $355,000 | +32% |

| Clearwater | $255,000 | $347,000 | +36% |

| Merritt | $323,000 | $418,000 | +29%

|

| Ashcroft | $273,000 | $367,000 | +34% |

| Cache Creek | $207,000 | $285,000 | +36% |

| Chase | $309,000 | $427,000 | +36% |

Clinton

| $155,000 | $176,000 | +17%

|

| Logan Lake | $282,000 | $402,000 | +34% |

| Lillooet | $271,000 | $348,000 | +30% |

Sun Peaks

| $921,000 | $1,146,000

| +25%

|

*All data calculated based on median values.

These examples demonstrate market trends for strata residential properties (e.g. condos/townhouses) by geographic area for select urban communities:*

Strata Home Changes (Condos/Townhouses)

By Community |

2021 Typical Assessed Value

as of July 1, 2020 |

2022 Typical Assessed Value

as of July 1, 2021 |

%

Change |

Kelowna

|

$371,000 |

$446,000 |

+20% |

West Kelowna

|

$374,000 |

$467,000 |

+24% |

Penticton

|

$287,000 |

$350,000 |

+20% |

Vernon

|

$281,000 |

$350,000 |

+25% |

Kamloops

|

$285,000 |

$346,000 |

+19% |

Sun Peaks

|

$529,000 |

$685,000 |

+28% |

*All data calculated based on median values.

BC Assessment's website at

bcassessment.ca includes more details about 2022 assessments, property information and trends such as lists of 2022's top valued residential properties across the province.

The website also provides self-service access to a free, online property assessment search service that allows anyone to search, check and compare 2022 property assessments for anywhere in the province. Property owners can unlock additional property search features by registering for a free BC Assessment custom account to check a property's 10-year value history, store/access favourites, create comparisons, monitor neighbourhood sales, and use our interactive map.

“Property owners can find a lot of valuable information on our website including answers to many assessment-related questions, but those who feel that their property assessment does not reflect market value as of July 1, 2021 or see incorrect information on their notice, should contact BC Assessment as indicated on their notice as soon as possible in January," says Tracy Wall.

“If a property owner is still concerned about their assessment after speaking to one of our appraisers, they may submit a Notice of Complaint (Appeal) by January 31st, for an independent review by a Property Assessment Review Panel," adds Wall.

The Property Assessment Review Panels, independent of BC Assessment, are appointed annually by the provincial government, and typically meet between February 1 and March 15 to hear formal complaints.

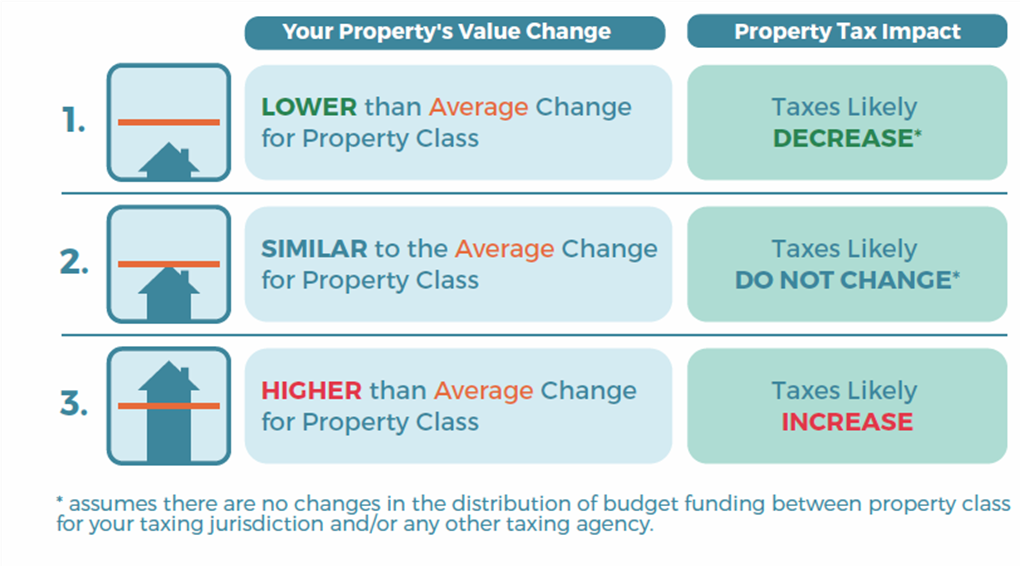

"It is important to understand that increases in property assessments do not automatically translate into a corresponding increase in property taxes," explains Tracy Shymko. "As noted on your assessment notice, how your assessment changes relative to the average change in your community is what may affect your property taxes."

Have questions?

“If your property was impacted by the 2021 floods, mudslides or wildfires, please take a few moments to contact us toll-free at 1-866-825-8322 during January once you receive your assessment notice," reinforces Shymko. “With your help, we can work together to make sure your property is valued correctly."

Property owners can contact BC Assessment toll-free at 1-866-valueBC (1-866-825-8322) or online at

bcassessment.ca. During the month of January, hours of operation are 8:30 a.m. to 5:00 p.m., Monday to Friday.

Follow BC Assessment on

Twitter,

YouTube,

Facebook, and

LinkedIn.

Media contacts:

Tracy Wall

Thompson Okanagan Deputy Assessor (Kelowna-Okanagan Area)

BC Assessment Tel. 1.866.825.8322 Ext. 19314 / 250-826-3641

Email:

tracy.wall@bcassessment.ca

Tracy Shymko

Thompson Okanagan Deputy Assessor (Kamloops-Thompson Area)

BC Assessment Tel. 1.866.825.8322 Ext. 23231/ 250-371-7808

Email:

tracy.shymko@bcassessment.ca

MEDIA BACKGROUNDER

Facts on B.C. Property Assessments and the 2022 Assessment Roll

- Total number of properties on the 2022 Roll is 2,142,457, an approximate 1.2 percent increase from 2021.

- Total value of real estate on the 2022 Roll is about $2.44 trillion, an increase of nearly 22 percent from 2021.

- Total amount of 'non-market change', including new construction, rezonings and subdivisions is approximately $33.9 billion, an increase of almost 53 percent from the 2021 Roll of $22.1 billion.

- In B.C., approximately 88.2 percent of all properties are classified with some residential (Class 1) component. This equates to $1,895,708,472,699 of the value on the total provincial roll.

- Over 98% of property owners typically accept their property assessment without proceeding to a formal, independent review of their assessment.

- Assessments are the estimate of a property's market value as of July 1, 2021 and physical condition as of October 31, 2021. This common valuation date ensures there is an equitable property assessment base for property taxation.

- Changes in property assessments reflect movement in the local real estate market and can vary greatly from property to property. When estimating a property's market value, BC Assessment's professional appraisers analyze current sales in the area, as well as considering other characteristics such as size, age, quality, condition, view and location.

- Real estate sales determine a property's value which is reported annually by BC Assessment. Local governments and other taxing authorities are responsible for property taxation and, after determining their own budget needs this spring, will calculate property tax rates based on the assessment roll for their jurisdiction.

- BC Assessment's assessment roll provides the foundation for local and provincial taxing authorities to raise over $8 billion in property taxes each year. This revenue funds the many community services provided by local governments around the province as well as the K-12 education system.

- BC Assessment's website provides a listing of property assessments and sales to help property owners understand their property's market value and provide comparable sales information. Go to bcassessment.ca and use “Find your property assessment". For more information on the 2022 Assessment Roll and regional and province-wide real estate market trends including lists of the province's top valued residential properties, please visit www.bcassessment.ca and click on the “Property Information & Trends" link.